Content

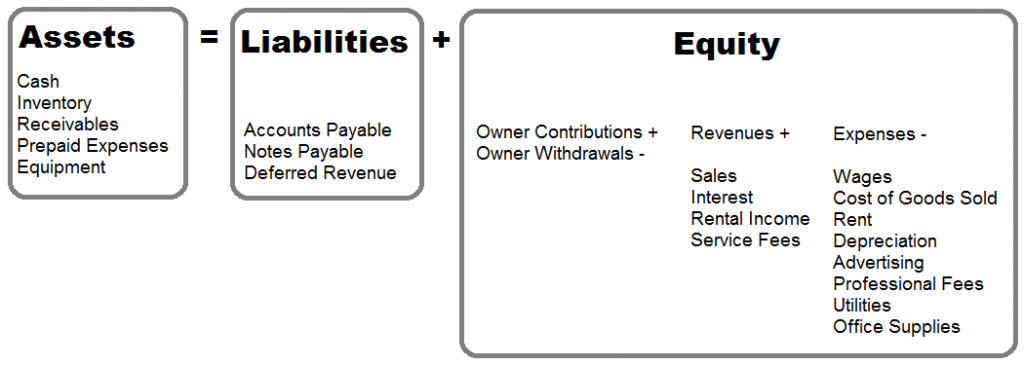

As a business owner, you have many options for paying yourself, but each comes with tax implications. The statements and opinions are the expression of the author, not LegalZoom, and have not been evaluated by LegalZoom for accuracy, completeness, or changes in the law. Knowing how—and when—to use the statements you’ve created is as important as creating them correctly in the first place. Cost of goods sold is defined as the direct costs attributable to the production of the goods sold in a company.

- Add the final calculation as a line item labeled Net Operational Income or Income from Operations at the bottom of your operating activities section.

- The statement also separates operating expenses into selling and administrative expenses.

- Erroneous data on an income statement can lead investors into making faulty assumptions about the company’s well-being.

- Businesses that are looking to raise funds from investors and creditors are likely to use multi-step income statements as well.

- Used by businesses that sell tangible goods or have more than one line of business, the multistep income statement, as its name implies, uses multiple steps instead of one.

- The single-step revenue statement is a simple and straightforward document.

Ideally, you want your net income to be positive, but at the beginning stages of your business, that may not be possible. Once those factors are accounted for, you’ll have your net profit before taxes, also known as pretax income. Read the income statement from top to bottom, the line items are placed in logical order. The Operating head is further divided into two important headings, which list down primary business incomes and the expenditures. It is usually known as Trading Account as well where Direct Incomes and Expenses are mentioned. It provides detailed insight into the breaks involved in the calculation of net income. With these numbers, stakeholders can see a business is performing against previous periods when it comes to generating the necessary profit to operate.

#1 Operating Head

This example of a multi-step income statement gives you an insight into the final report. This example of a single-step income statement gives you an insight into the final report. You have a bigger company and you need more detail in your income statements. The first formula helps you calculate gross profits, which is integral to the preparation of this type of statements. Although the multi-step income statement comes with greater detail, it is not perfect.

Should freight be included in revenue?

Companies must report shipping and freight as revenue when they bill a customer for these charges. … Shipping charges billed to customers can represent revenue.

Another measurement available from the multi-step income statement is operating income. Like gross profit, operating income provides business owners with more detailed information on company profitability rather than focusing solely on net income. The second calculation subtracts the company’s operating expenses, such as office supplies and advertising costs, to arrive at the operating income. This can be useful, as it only takes into account the items that have to do with the company’s business activities, and excludes certain one-time costs and the performance of any investments the company holds.

What Is An Example Of An Income Statement?

Because gross profit focuses only on sales revenue and cost of goods sold, business owners have a better idea about how profitable their core business operation really is. Preparing a multi-step income statement is a more complex and time-consuming process than the preparation of the single-step format.

- A multi-step income statement uses an itemized list of revenues and expenses.

- The costs in the production of the goods are included in the cost of sales .

- Other sources of information for the statement might include, for example, documentation that details the company’s core business activities so as to differentiate between operating and non-operating items.

- Multi-step income statements detail a company’s operating income, which reveals how profitably it generates revenue from its major business activities.

- The siloed breakdowns in multiple-step income statements allow for deeper analysis of margins and provide more accurate representations of the costs of goods sold.

- To arrive at net income, a single-step income statement uses only one computation.

We may receive compensation from partners and advertisers whose products appear here. Compensation may impact where products are placed on our site, but editorial opinions, scores, and reviews are independent from, and never influenced by, any advertiser or partner.

Multiple Step Vs Single Step Income Statement

If you’re creating a multi-step income statement for the first quarter of 2020, your trial balance should be prepared for the same quarter. The single-step income statement is the easiest income statement format to prepare, focusing mainly on net income. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle.

Which item appears on a single-step income statement and a multiple-step income statement?

Explanation: Cost of goods sold is an expense account that appears on both a single-step and multiple-step income statement. Gross profit and income from operations is a calculation only shown on the multiple-step income statement.

A multi-step income statement evaluates how a company earns a profit from its initial business activities. A multi-step income statement helps to give an insight into gross profit, how a business uses labor and supplies to generate revenue. A single-step income statement is a single-step process, whereas a multi-step income statement is a three-step process to calculate the company’s net income and profit.

Track The Cost Of Sales

For an expense or income to be called a non-operating activity, it should be an extraordinary item that is not part of the company’s operations. Examples of a non-operating income include gain from the sale of an asset, gain incurred in foreign exchange dealings, dividend income and profit from investments. In addition to the name of the company and the name of the financial statement, the heading of the income statement informs the reader of the period or time interval during which the reported amounts occurred. Typical periods of time are a year, year-to-date, three months, one month, 52 weeks, 13 weeks, 4 or 5 weeks, and others. Other income and expenses like interest, lawsuit settlements, extraordinary items, and gains or losses from investments are also listed in this section.

Multi Step Vs Single Step Income Statement https://t.co/yQvFa8B1vg

— Zihuatanejo Digital (@zihuatanejodem) December 3, 2021

This might include losses from an investment that is not performing well or payments made on lawsuits or legal fees. Reporting in periods like monthly, quarterly or annual is common practice for businesses. If you’re going to create an income statement, you’ll need to define the periods that make the most sense for your reporting needs. Businesses might choose a reporting schedule that revolves around the timing of board meetings or other reporting events. Make sure you choose the right period in order to gather accurate results for interpretation.

Different Parts Of Operating Activities In A Cash Flow Statement

These expenses can include wages of admin staff, factory and warehouse rent, utilities, etc. Once the non-operating section is totaled, it is subtracted from or added to the income from operations to compute the net income for the period. The users will know the profit earned from the primary activities of buying and selling goods and how it differs from the non-operating activities.

Blindedbysound 847-599 – Blinded By Sound

Blindedbysound 847-599.

Posted: Wed, 22 Dec 2021 01:50:21 GMT [source]

Remember to include things like interest and transactions around investments. These single step vs multi step income statement are collected in different line items in a company’s accounting software platform.

Hopefully, this article will help you choose the best way to make an income statement for your business. Apportionment divides business income subject to state corporate income or other business taxes to jurisdictions based on formulas to determine taxes due in each state. Incorrect apportionment can result in incorrect payments and state tax audits.

Administrative expenses are expenses a company incurs in the overall management of a business. Examples include administrative salaries, rent and utilities on an administrative building, insurance expense, administrative supplies used, and depreciation on office equipment. The total operating expenses are a combination of both selling and admin expenses. These total expenses can then be subtracted from gross profit to arrive at the operating income.

Add the final calculation as a line item labeled Net Operational Income or Income from Operations at the bottom of your operating activities section. Subtract the cost of items sold from the net sales to arrive at the gross profit. Under the cost of goods sold, add the final number as a line item and call it Gross Profit. Give your statement a final QA either manually or using an automated platform. Using software allows you to automatically track and organize your business’s accounting data so you can easily access and review income statements. Using information on the income statement, companies can use earnings per share to measure profitability. Earnings per share can be calculated by dividing the company’s profits by shares of common stock.

Small Business Owner…

Multi Step Vs. Single Step

Income Statement… what is the difference and what is best for you?— eamurrayinc (@eamurrayinc) January 10, 2020

As a business owner or employee within the business, creating monthly income statements can assist in tracking how things are going. Law requires publicly traded companies to prepare one quarterly and annually. Ultimately, income statements keep track of everything going in and out and can act as a guide for business decisions—big or small. Analyzing the income statement can provide insights into the profitability of a company, as well as the potential for future growth.

Each of these relationships is important because of the way it relates to an overall measure of business profitability. However, because of large sales commissions and delivery expenses, the owner may realize only a very small amount of the gross margin as profit. Income from Operations is Gross profit operating expenses and represents the amount of income directly earned by business operations. Although Bob and his donut shop are still a small business and would not have otherwise been required to create a multi-step statement, he wants to take out a bank loan of $25,000. The bank has requested that Bob must present the income statement in a multi-step format to get a better picture of his business.

NA Proactive news snapshot: CULT Food Science, Kenorland Minerals, Levitee Labs, American Resources, Real Luck Group UPDATE … – Proactive Investors USA

NA Proactive news snapshot: CULT Food Science, Kenorland Minerals, Levitee Labs, American Resources, Real Luck Group UPDATE ….

Posted: Mon, 20 Dec 2021 17:26:15 GMT [source]

News Learn how the latest news and information from around the world can impact you and your business. Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments. Investors may not put their funds in a company that does not reveal all the information. Use of our products and services are governed by ourTerms of Use andPrivacy Policy.